All About Coffee, William H. Ukers [short story to read .txt] 📗

- Author: William H. Ukers

- Performer: -

Book online «All About Coffee, William H. Ukers [short story to read .txt] 📗». Author William H. Ukers

This contract is made in view of, and in all respect subject to the rules and conditions established by the New York Coffee and Sugar Exchange, Inc., and in full accordance with section 102 of the bylaws.

_____________________________

Brokers

Across the face is the following:

For and in consideration of one dollar to __________________ in hand paid, receipt whereof is hereby acknowledged, ______________ accept this contract with all its obligations and conditions.

All deliveries on such future contracts must be made from licensed warehouses. There is a separate "to arrive contract"; but this likewise requires delivery at a licensed warehouse, unless the buyer and the seller have a mutual understanding to deliver the coffee from dock or ex-ship. Margins to protect the contract may be called for by either party. The largest deposit for margins was made in 1904, when $22,661,710 was deposited with the superintendent as required by the Exchange rules.

The basic grade in a future sale is No. 7; but variations are provided as follows: 30 points for Rio, Victoria, and Bahia of all grades between 7 and 1, and of 50 points between 7 and 8; 50 points is allowed on Santos and all other coffees except between grades 1 and 2 and 2 and 3 Santos, which are allowed 30 points. Thus the buyer and the seller when entering upon a transaction know exactly what the difference will be between the standard No. 7 and the coffee that can be delivered. The right to deliver any grade in a future transaction has done much to lessen the probability of corners in coffee; but this protection is further given by the stringent rule that the maximum fluctuations on the Exchange can be only two cents a pound on coffee in one day and one cent on sugar. If greater changes should threaten, the Exchange operations would automatically cease.

False or fictitious sales are prohibited, and all contracts must be reported to the superintendent. All contracts are binding and call for actual delivery.

The future contract, besides being used for the delivery of coffee during stated months in the future at a given price, is also used for hedging purposes. As in the grain and cotton markets, dealers protect themselves against price fluctuations by hedging in the future market. Importers, for instance, when purchasing coffee abroad, frequently sell an equal amount for future delivery on the Exchange. When the time for delivery arrives, it is simply a question of calculation of the market conditions whether it is more advantageous to repurchase the sales made as a hedge, or as a kind of insurance to protect themselves against loss, and free the coffee so engaged, or to make delivery of the coffee as it comes in.

The board of managers has power to close the Exchange or to suspend trading on such days or parts of days as would in their judgment be for the Exchange's best interest.

The Clearing Association is a recent outgrowth of the Exchange, and is composed exclusively of Exchange members. Every member has to bring his contracts up to market closing every night, either by making a deposit with the Association to cover his balances, or by withdrawing in case he should be over. Members deposit $15,000 at the time of joining as a guaranty fund; and if the surplus is not sufficient to take care of balances, the bylaws provide for the levying of assessments.

The daily quotations on the coffee exchanges of New York, Havre, and (before the war) of Hamburg, determined to a large extent the price of green coffee the world over. The prices prevailing on the New York Coffee and Sugar Exchange are studied by coffee traders in all countries, the fluctuations being reflected in foreign markets as the reports come from the United States. Quotations are cabled from one great market to another; and as each must heed those of the others to some extent, the coffee trade thus obtains a world price, and the effect on supply and demand is universal rather than local, as would be the case if quotations were not exchanged.

In 1921 the Exchange adopted an amendment to the trade rules, and abolished the one day transferable notice for both coffee and sugar.

Foreign Coffee Quotations

Brazil coffee cable quotations are the market prices, in Rio or Santos, of ten kilograms of coffee, the price being stated in milreis, the monetary unit of Brazil money. The basic grade of coffee at Rio is the No. 7 of the New York Coffee Exchange; and at Santos, the international standard of good average ("g. a.") Santos. One kilogram (often written kilo, or abbreviated to K.) is equal to two and one-fifth pounds; and the ten-kilogram standard of quantity is, therefore, equivalent to twenty-two pounds, or just one-sixth of a standard Brazil bag.

The money value is not so simple, since Brazilian paper currency is unstable; and the milreis quotation means nothing unless it is considered in connection with the rate of exchange for the same day, i.e., the current gold value of the milreis. This gold value is always given with the daily quotations from Brazil, and is expressed in British pence. The par value of the milreis (1000 reis) is 54.6 cents (gold) of United States money; but its present actual value is only about 15 cents, and it has been as low as 111⁄4 cents. Our dollar sign is used to denote milreis, placing it after the whole number, and before the fractional part expressed in one-thousandths. Thus, 81⁄4 milreis would be written 8$250 RS.

Suppose, for example, a Rio quotation is given at 8$400, with exchange at 71⁄2 d. This means that 22 pounds of coffee have a gold value of 63 British pence (8.4 × 71⁄2 = 63.0), or 5⁄3, as the Englishman would write it, which is equal to $1.271⁄2, making the coffee worth 5.8 cents per pound. Of course the person familiar with Brazil quotations will not need to make this reduction to the pound-cent term in order to understand the figures. They will have a proper relative meaning to him in their original form; and it must not be overlooked that it is in this form only that they express correctly the value of the coffee in Brazil. It may make a great difference to the Brazilian planter or exporter whether an increased gold value of his coffee arises through a higher milreis bid or an appreciated exchange, simply on account of local currency considerations. That is to say, the purchasing power of a milreis in Brazil will not necessarily vary exactly as the rate of exchange on London.

London quotations are made in shillings and pence, on one hundred-weight (cwt) of coffee. This "cwt" is not 100 pounds but 112 pounds, one twentieth of the English ton (our long ton) of 2,240 pounds. And in all English coffee statistics the coffee quantities are expressed in this ton. A London quotation of 30/9 (30 shillings and 9 pence) for example, is equivalent to $7.44 for 112 pounds of coffee, or 6.64 cents per pound at the normal rate of exchange, $4.80 to $4.86 the pound sterling.

At Havre, the coffee price is given in francs, on a quantity of 50 kilograms. This is 110 pounds and almost as much, therefore, as the British cwt. In normal times the franc is equal to 19.3 cents. A French quotation of 371⁄2, for instance, means, therefore, $7.19 for 110 pounds of coffee, or 6.53 cents per pound.

The Hamburg quotation (formerly from Brazil per fifty kilos) is made on one pound German, equal to 1⁄2 kilogram, and is expressed in pfennigs. One pfennig is one-hundredth of a mark, and the mark once was equal to 23.8 cents. A German quotation of, say, 31, means, therefore, 7.38 cents (31 × .238 = 7.378) for 1.1 pounds, or 6.71 cents per pound.

Three Kinds of Brokers

In the coffee trade there are three kinds of brokers—floor, spot, and cost and freight.

Floor brokers are those who buy and sell options on the Coffee Exchange for a fixed consideration per lot of 250 bags. The coffee commission rate put into effect June 8, 1920, for round term (buying and selling) by the New York Coffee Exchange was as follows:

Commission Rate on 250 Bags

(For Round Term—Buying and Selling) Up to 9.99c

per lb. 10c to 19.99c

per lb. 20c & up

per lb. Members $12.50 $15.00 $20.00 Non-members 25.00 30.00 40.00 Foreign members 17.50 20.00 25.00 Foreign non-members 30.00 35.00 45.00 Floor brokerage—Buying or selling 1.50 1.75 2.00

There is at present (1922) a stamp tax of two cents on each hundred dollars value, or fraction thereof, figured on each separate lot.

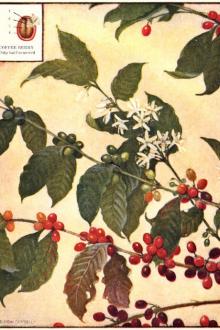

Near View of Heavily Laden Trees Ready for the Pickers Near View of Heavily Laden Trees Ready for the Pickers

TYPICAL COFFEE SCENES IN COSTA RICA

Spot brokers are those who deal in actual coffee, selling from jobber to jobber, or representing out-of-town houses; the seller paying a commission of about fifteen cents a bag in small lots, and half of one percent in large lots.

Cost and freight brokers represent Brazilian accounts, and generally receive a brokerage of one and one-quarter percent. On out-of-town business, they usually split the commission with the out-of-town or "local" brokers. The out-of-town brokers sometimes, however, deal direct with the importer. All brokers except floor brokers are sometimes called "street brokers." Most of the large New York, New Orleans, and San Francisco brokerage houses also do a commission business, handling one or more Brazilian or other coffee-producing-country accounts.

Important Rulings Affecting Coffee Trading

The United States have no coffee law as they have a tea law—prescribing "purity, quality and fitness for consumption"—but buyers and sellers of green coffees are required to observe certain well defined federal rules and regulations relating specifically to coffee. Up to the year 1906, when the Pure Food and Drugs Act became law, the green coffee trade was practically unhampered; and several irregularities developed, calling into existence federal laws that were designed to protect the consumer against trade abuses, and at the same time to raise the standards of coffee trading.

Under these regulations it is illegal to import into this country a coffee that grades below a No. 8 Exchange type, which generally contains a large proportion of sour or damaged beans, known in the trade as "black jack," or damaged coffee, as found in "skimmings." "Black jack" is a term applied to coffee that has turned black during the process of curing, or in the hold of a ship during transportation; or it may be due to a blighting disease.

Another ruling is intended to prevent the sale of artificially "sweated" coffee, which has been submitted

Comments (0)