A GUIDE FOR FINANCIAL FRAUD INVESTIGATION & PRECAUTION, SHIVANI SHARMA [read my book txt] 📗

- Author: SHIVANI SHARMA

Book online «A GUIDE FOR FINANCIAL FRAUD INVESTIGATION & PRECAUTION, SHIVANI SHARMA [read my book txt] 📗». Author SHIVANI SHARMA

Legal corruption[edit]

Though corruption is often viewed as illegal, there is an evolving concept of legal corruption,[6][101][original research?] as developed by Daniel Kaufmann and Pedro Vicente. It might be termed as processes which are corrupt, but are protected by a legal (that is, specifically permitted, or at least not proscribed by law) framework.[102]

Examples of legal corruption[edit]

In 1977 the USA had enacted the Foreign Corrupt Practices Act (FCPA)[103] "for the purpose of making it unlawful... to make payments to foreign government officials to assist in obtaining or retaining business" and invited all OECD countries to follow suit. In 1997 a corresponding OECD Anti-Bribery Convention was signed by its members.[104][105]

17 years after the FCPA enacting, a Parliamentary Financial Commission in Bonn presented a comparative study on legal corruption in industrialized OECD countries[106] As a result, they reported that in most industrial countries even at that time (1994) foreign corruption was legal, and that their foreign corrupt practices had been diverging to a large extent, ranging from simple legalization, through governmental subsidization (tax deduction), up to extremes like in Germany where foreign corruption was fostered, whereas domestic was legally prosecuted. Consequently, in order to support national export corporations the Parliamentary Financial Commission recommended to reject a related previous Parliamentary Proposal by the opposition leader which had been aiming to limit German foreign corruption on the basis of the US FCPA.[107] Only after the OECD Anti-Bribery Convention came into force, did Germany withdraw the legalization of foreign corruption in 1999.[108]

Foreign corrupt practices of industrialized OECD countries 1994 study[edit]

The Foreign corrupt practices of industrialized OECD countries 1994 (Parliamentary Financial Commission study, Bonn).[106]

Belgium: bribe payments are generally tax deductible as business expenses if the name and address of the beneficiary is disclosed. Under the following conditions kickbacks in connection with exports abroad are permitted for deduction even without proof of the receiver:

Payments must be necessary in order to be able to survive against foreign competition They must be common in the industry A corresponding application must be made to the Treasury each year Payments must be appropriate The payer has to pay a lump-sum to the tax office to be fixed by the Finance Minister (at least 20% of the amount paid).In the absence of the required conditions, for corporate taxable companies paying bribes without proof of the receiver, a special tax of 200% is charged. This special tax may, however, be abated along with the bribe amount as an operating expense.

Denmark: bribe payments are deductible when a clear operational context exists and its adequacy is maintained.

France: basically all operating expenses can be deducted. However, staff costs must correspond to an actual work done and must not be excessive compared to the operational significance. This also applies to payments to foreign parties. Here, the receiver shall specify the name and address, unless the total amount in payments per beneficiary does not exceed 500 FF. If the receiver is not disclosed the payments are considered "rémunérations occult" and are associated with the following disadvantages:

The business expense deduction (of the bribe money) is eliminated. For corporations and other legal entities, a tax penalty of 100% of the "rémunérations occult" and 75% for voluntary post declaration is to be paid. There may be a general fine of up 200 FF fixed per case.Japan: in Japan, bribes are deductible as business expenses that are justified by the operation (of the company) if the name and address of the recipient is specified. This also applies to payments to foreigners. If the indication of the name is refused, the expenses claimed are not recognized as operating expenses.

Canada: there is no general rule on the deductibility or non-deductibility of kickbacks and bribes. Hence the rule is that necessary expenses for obtaining the income (contract) are deductible. Payments to members of the public service and domestic administration of justice, to officers and employees and those charged with the collection of fees, entrance fees etc. for the purpose to entice the recipient to the violation of his official duties, can not be abated as business expenses as well as illegal payments according to the Criminal Code.

Luxembourg: bribes, justified by the operation (of a company) are deductible as business expenses. However, the tax authorities may require that the payer is to designate the receiver by name. If not, the expenses are not recognized as operating expenses.

Netherlands: all expenses that are directly or closely related to the business are deductible. This also applies to expenditure outside the actual business operations if they are considered beneficial as to the operation for good reasons by the management. What counts is the good merchant custom. Neither the law nor the administration is authorized to determine which expenses are not operationally justified and therefore not deductible. For the business expense deduction it is not a requirement that the recipient is specified. It is sufficient to elucidate to the satisfaction of the tax authorities that the payments are in the interest of the operation.

Austria: bribes justified by the operation (of a company) are deductible as business expenses. However, the tax authority may require that the payer names the recipient of the deducted payments exactly. If the indication of the name is denied e.g. because of business comity, the expenses claimed are not recognized as operating expenses. This principle also applies to payments to foreigners.

Switzerland: bribe payments are tax deductible if it is clearly operation initiated and the consignee is indicated.

US: (rough résumé: "generally operational expenses are deductible if they are not illegal according to the FCPA")

UK: kickbacks and bribes are deductible if they have been paid for operating purposes. The tax authority may request the name and address of the recipient."

"Specific" legal corruption: exclusively against foreign countries[edit]

Referring to the recommendation of the above-mentioned Parliamentary Financial Commission's study,[106] the then Kohl administration (1991–1994) decided to maintain the legality of corruption against officials exclusively in foreign transactions[109] and confirmed the full deductibility of bribe money, co-financing thus a specific nationalistic corruption practice (§4 Abs. 5 Nr. 10 EStG, valid until March 19, 1999) in contradiction to the 1994 OECD recommendation.[110] The respective law was not changed before the OECD Convention also in Germany came into force (1999).[111] According to the Parliamentary Financial Commission's study, however, in 1994 most countries' corruption practices were not nationalistic and much more limited by the respective laws compared to Germany.[112]

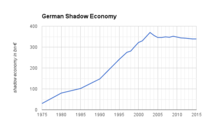

Development of the shadow economy in (West-) Germany 1975–2015. Original shadow economy data from Friedrich Schneider, University Linz.

Development of the shadow economy in (West-) Germany 1975–2015. Original shadow economy data from Friedrich Schneider, University Linz.

Particularly, the non-disclosure of the bribe money recipients' name in tax declarations had been a powerful instrument for Legal Corruption during the 1990s for German corporations, enabling them to block foreign legal jurisdictions which intended to fight corruption in their countries. Hence, they uncontrolled established a strong network of clientelism around Europe (e.g. SIEMENS)[113] along with the formation of the European Single Market in the upcoming European Union and the Eurozone. Moreover, in order to further strengthen active corruption the prosecution of tax evasion during that decade had been severely limited. German tax authorities were instructed to refuse any disclosure of bribe recipients' names from tax declarations to the German criminal prosecution.[114] As a result, German corporations have been systematically increasing their informal economy from 1980 until today up to 350 bn € per annum (see diagram on the right), thus continuously feeding their black money reserves.[115]

A Siemens corruption case[edit]

In 2007, Siemens was convicted in the District Court of Darmstadt of criminal corruption against the Italian corporation Enel Power SpA. Siemens had paid almost €3.5 million in bribes to be selected for a €200 million project from the Italian corporation, partially owned by the government. The deal was handled through black money accounts in Switzerland and Liechtenstein that were established specifically for such purposes.[116] Because the crime was committed in 1999, after the OECD convention had come into force, this foreign corrupt practice could be prosecuted. According to Bucerius Law School professors Frank Saliger and Karsten Gaede, for the first time a German court of law convicted foreign corrupt practices like national ones although the corresponding law did not yet protect foreign competitors in business.[117]

During the judicial proceedings however it was disclosed that numerous such black accounts had been established in the past decades.[113]

Historical responses in philosophical and religious thought[edit]

Philosophers and religious thinkers have responded to the inescapable reality of corruption in different ways. Plato, in The Republic, acknowledges the corrupt nature of political institutions, and recommends that philosophers "shelter behind a wall" to avoid senselessly martyring themselves.

Disciples of philosophy ... have tasted how sweet and blessed a possession philosophy is, and have also seen and been satisfied of the madness of the multitude, and known that there is no one who ever acts honestly in the administration of States, nor any helper who will save any one who maintains the cause of the just. Such a savior would be like a man who has fallen among wild beasts—unable to join in the wickedness of his fellows, neither would he be able alone to resist all their fierce natures, and therefore he would be of no use to the State or to his friends, and would have to throw away his life before he had done any good to himself or others. And he reflects upon all this, and holds his peace, and does his own business. He is like one who retires under the shelter of a wall in the storm of dust and sleet which the driving wind hurries along; and when he sees the rest of mankind full of wickedness, he is content if only he can live his own life and be pure from evil or unrighteousness, and depart in peace and good will, with bright hopes.[118]

The New Testament, in keeping with the tradition of Ancient Greek thought, also frankly acknowledges the corruption of the world (ὁ κόσμος)[119] and claims to offer a way of keeping the spirit "unspotted from the world."[120] Paul of Tarsus acknowledges his readers must inevitably "deal with the world,"[121] and recommends they adopt an attitude of "as if not" in all their dealings. When they buy a thing, for example, they should relate to it "as if

Comments (0)