A GUIDE FOR FINANCIAL FRAUD INVESTIGATION & PRECAUTION, SHIVANI SHARMA [read my book txt] 📗

- Author: SHIVANI SHARMA

Book online «A GUIDE FOR FINANCIAL FRAUD INVESTIGATION & PRECAUTION, SHIVANI SHARMA [read my book txt] 📗». Author SHIVANI SHARMA

I

FORENSIC ACCOUNTING AND FRAUD INVESTIGATION

CHAPTERS OR TOPICS

SUBJECT TO INTRODUCTION TO FRAUD FINANCIAL INVESTIGATIONWHY ARE THESE FRAUDS HAPPEN

FINANCIAL INVESTIGATIONTRIANGLE OF FRAUD ACTION: THE CRIME

FINANCIAL INVESTIGATIONSTRATEGIES FOR FRAUD PREVENTION IN YOUR BUSINESS

FINANCIAL INVESTIGATIONPREVENTION OF MONEY LAUNDERING ACT 2002

FINANCIAL INVESTIGATION'Anti Money Laundering - AML'

FINANCIAL INVESTIGATION CRYPTO-CURRENCY FINANCIAL INVESTIGATION BIT-COINS FINANCIAL INVESTIGATION WHISTLEBLOWER FINANCIAL INVESTIGATION EXAMPLE OF WHISTLEBLOWER POLICY FINANCIAL INVESTIGATION 20 WAYS OF FRAUD DETECTION FINANCIAL INVESTIGATION FORENSIC ACCOUNTING FINANCIAL INVESTIGATION INTELLECTUAL PROPERTY RIGHT ACTFINANCIAL INVESTIGATION

Type of FraudFINANCIAL INVESTIGATION

FORGERYFINANCIAL INVESTIGATION

LOAN SHARKIG FINANCIAL INVESTIGATION Corruption FINANCIAL INVESTIGATION Insider trading FINANCIAL INVESTIGATION INTRODUCTION TO FRAUDSSome of the common myths associated with frauds are " It won't happen to me!" or "We have everything under control" or " We have hired efficient auditors". Bu the one can say that this attitude stems from that lack of accurate knowledge of the depth and volume of fraud that penetrates ( make a hole in) cooperation this days. The first question which errupt in our mind is what is fraud.

1). WHAT IS FRAUD ?

ANS: Fraud can be defined as the " Illegal act of obtaining something valuable through willful misrepresentation" OR " a deception practiced in other to secure unfair or unlawful gain". Risk and materiality are two concepts closely associated with fraud. Risk refers to the simple risk of a potential fraud and materiality to a amount of losses due to these frauds.

2). HOW SIGNIFICANT ARE THE THESE LOSSES TO A COMPANY?

ANS: How significant are these losses to a company is a second question that arrive in our mind related to fraud. From small internet banking to credit card fraud, stupendous scams to contract breaches, internal frauds to hacking and cyber crimes. We are constantly being defrauded in more than one way. Handling this type of frauds requires a solid technical knowledge-base. And its is equally important for individual and organization (both big and small) to understand the risk and materiality associated with frauds.

The significance of these losses to a company can be accuratelly computed only if the likelihood of a risk incurring in an organization can be estimated. Certainly not an eassy figure to compute.

Howerver studies conducted in past have shown that an organization in the 1990's had more than 60% risk of experiancing a fraud incidences in a period of one year. Clearly the likelihood of such an occurance today can only be higher due to sudden spurt in the number and complexity of prossesing and transactions and the uncanny (strange or mysterious, especially in an unsettling way.) growth of cyber crimes today.Not only frauds increasing, but so are the incidence of these frauds !

WHY ARE THESE FRAUD COMMITTED?

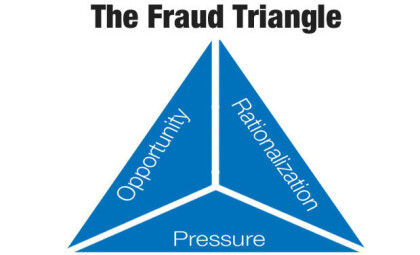

Why are these frauds even commited? What prompts these first timers to commits them? This can be explain by fraud triangle given below.

THE fraud triangle is a frame work designed to explain the reasoning behind a worker's decicion to commit workplace frauds. The popularly known as fraud triangle encompasses the basic factors that influence the occurance of frauds; name pressure, opportunity and rationalization. its is often said that breaking the fraud's triangle is the key of brakeing the fraud occurrance in the organization.

1).PRESSURE:- The pressure of the individual is the motivation behind the crime and can be either personal fiancial pressure, such as debth problems or workplace debth problem, such as a shortfall in revenue. The pressure is seen by the individual as unsolveable by orthodox , legal, sanctioned routes and unsharable with other who may be able to offer assitance.A common example of perecived unsharable fiancial problem is glambling debts. Maintenance of a lifestyle is another common example.

2).OPPORTUNITY:- the opportunity to commit fraud is the means by which the individual will defraud the organization.In this stage the worker see a clear course of action by which they can abuse their position to solve the perceived unsharable financial problems in a way that again preceived by them is unlikely to be discovered . In many cases the ability to solve the problem in secret is the key to perception of a avilable opportunity.

3).RATIONALIZATION:- The ability rationalize the crime is the final stage in the fraud triangle. This is a congnitive stage and requiers the fraudster to beable to justify the crime in a way that is accepted to his or her internal moral compass. Most fraudster are first tme criminals and do not see themself as criminals but rather as a victim of a circumtances. rationalization are offten based on external factor such as need to take care of a family or a dishonest employers.

Using The Fraud Triangle

The fraud triangle provides a useful framework for organizations to analyze their vulnerability to fraud and unethical behavior, and it provides a way to avoid being victimized. Almost universally, all three elements of the triangle must exist for an individual to act unethically. If a company can focus on preventing each factor, it can avoid creating fertile ground for bad behavior.

Relieve Pressure

Companies only have so much impact on the personal lives of customers and employees. Identifying any possible pressures that the company could have an impact on – such as money problems, substance abuse, etc. – can be helpful. Working to relieve these issues can help prevent criminal behavior.

Minimize Opportunity

Companies should always be looking to minimize the opportunity for fraud and unethical behavior. Brumell Group can assist with this. Working as a Fraud Consultant, Brumell Group can help companies analyze operations, review internal controls and address any current or future vulnerabilities. It is a worthwhile investment for any organization that wants to remain secure against the hazards of fraud.

Target Rationalization

One way to prevent fraud is to keep individuals from ever being able to rationalize the behavior in the first place. Companies can create a “zero tolerance” policy towards fraudulent behavior, and remind employees and customers of this policy on a regular basis. Companies can also make certain that individuals know the cost of fraud to other customers and other employees. Letting individuals know that there are heavy consequences makes it more difficult to minimize the unethical behavior.

OTHER INFORMATION:- FRAUD EXAMINER relie on th fraud triangle to find the weak points in the buisness and identify possible suspets in cases of fraud. Its consists three core concepts that togather create a situation ripe for fraud; incevtives , oppourtunity and rationalization.People must have incentives and opportunity to commit frauds as well as the abality to justify it. Recent analysis has suggested adding the fourth concept makeing it diamond and that is capability. Just because someone has a oppourtunity or incetives to steal, that dosen't mean they have capability to do so. For example if someone dosen't how to do journals or ledger enteries they would not know how to maniuplate the number no matter what the insentives and oppourtunity is.

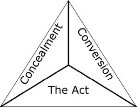

TRIANGLE OF FRAUD ACTION : THE CRIMETriangle of fraud action is a process that explain how the frauds or crime are conducted.The Triangle of Fraud Action is valuable to the investigator where proof of intent is required. The triangle of fraud action can be determinded, controlled and detected by anti fraud professionals.Where fraud triangle points investigator to why people might commit fraud , the evidenitary trail might be weak or non-existant for instance pressure and rationalization are not directly observable. According to Ramamooril (2008) a lack of fraud evidance is not a proof that fraud has not occur, hence anti fraud professional need an evidance based approach to conduct investigation.

Therefore, anti-fraud professionals need an evidenced-based approach to conduct investigations. The Triangle of Fraud Action is helpful in this regard because the elements can be directly observed and documented. The Triangle of Fraud Action, therefore, represents a model for detecting white-collar crimes and obtaining prosecutorial evidence. Evidence of the act, concealment, and conversion can be collected and presented during adjudication. Further, when considered in total, the Triangle of Fraud Action makes it difficult for the perpetrator to argue that the act was accidental or to deny his/her role in the act. Evidence of concealment, in particular, provides a compelling argument that the act was intentional.This is where the forensic techiques was relevant.

Albercht et al (2006) and kranacher el al (2011) describe an action of an individual must perform to prepetrate fraud as follow:

THE TRIANGLE OF FRAUD ACTION

THE TRIANGLE OF FRAUD ACTION

The triangle of fraud action consists three elements: the act , concealment and converstion.

1). THE ACTION:- it is a stage where the fraud is already perform like the execution of the fraud, emberzzlement, check kritting or material fraudulent fiancial reporting.

2). CONCEALMENT:- IN this stage the fraudster deliberately try to hide the fraud by not desclosing it or by suppresing of a material fact or circumstances

Comments (0)