A GUIDE FOR FINANCIAL FRAUD INVESTIGATION & PRECAUTION, SHIVANI SHARMA [read my book txt] 📗

- Author: SHIVANI SHARMA

Book online «A GUIDE FOR FINANCIAL FRAUD INVESTIGATION & PRECAUTION, SHIVANI SHARMA [read my book txt] 📗». Author SHIVANI SHARMA

11)TYPE OF CRYPTO-CURRENCY:-

THERE ARE TOTAL 140 TYPES OF CRYPTO-CURRENCY SOME OF THEM ARE ALSO INACTIVE.THEY ARE AS FOLLOW:

BIT-COINS NAME-COIN LITE-COIN SHIFT-COIN BYTE-COIN PEER-COIN DOGE-COIN EMER-COIN FEATHER-COIN GRID-COIN OMINI PRIME-COIN RIPPLE NXT AURORA-COIN BLACK- COIN BRUST-COIN COYINE IS INACTIVE DASH NEO MAZA-COIN MONERO TIT-COIN NEM TETHER POT-COIN SYNEREO AMP VERT-COIN EITHER OR ETHEREUM STELLAR VERGE ETHEREUM CLASIC WAVES PLATFORM IOTA DECRED LISK ZCASH ZCLASSIC BITCONNECT IS INACTIVE COMODO BITCOIN CASH UBIG EOSIO SIRINS LAB TRON CARDANO KODAK-COIN IS INACTIVE PETRO PETRO GOLD IS IN PROPOSEAL

BIT-COINS

BIT-COINS

Bitcoin is a cryptocurrency and worldwide payment system.It is the first decentralized digital currency, as the system works without a central bank or single administrator.The network is peer-to-peer and transactions take place between users directly, without an intermediary. These transactions are verified by network nodes through the use of cryptography and recorded in a public distributed ledger called a blockchain. Bitcoin was invented by an unknown person or group of people under the name Satoshi Nakamotoand released as open-source software in 2009.

Bitcoins are created as a reward for a process known as mining. They can be exchanged for other currencies, products, and services. As of February 2015, over 100,000 merchants and vendors accepted bitcoin as payment.Research produced by the University of Cambridge estimates that in 2017, there were 2.9 to 5.8 million unique users using a cryptocurrency wallet, most of them using bitcoin.

1)ETYMOLOGY:-The word bitcoin first occurred and was defined in the white paper that was published on 31 October 2008. It is a compound of the words bit and coin. The white paper frequently uses the shorter coin.There is no uniform convention for bitcoin capitalization. Some sources use Bitcoin, capitalized, to refer to the technology and network and bitcoin, lowercase, to refer to the unit of account. The Wall Street Journal,The Chronicle of Higher Education and the Oxford English Dictionary advocate use of lowercase bitcoin in all cases, a convention followed throughout this article.

2)Units:-The unit of account of the bitcoin system is a bitcoin. Ticker symbols used to represent bitcoin are BTC and XBT. Its Unicode character is ₿.[26]:2 Small amounts of bitcoin used as alternative units are millibitcoin (mBTC), bit (ƀ)better source needed][better source needed] and satoshi (sat). Named in homage to bitcoin's creator, a satoshi is the smallest amount within bitcoin representing 0.00000001 bitcoins, one hundred millionth of a bitcoin. A bit equals 0.000001 bitcoins, one millionth of a bitcoin or 100 satoshis. A millibitcoin equals 0.001 bitcoins, one thousandth of a bitcoin or 100,000 satoshis.

3)History:-On 18 August 2008, the domain name "bitcoin.org" was registered.In November that year, a link to a paper authored by Satoshi Nakamoto titled Bitcoin: A Peer-to-Peer Electronic Cash System was posted to a cryptography mailing list.Nakamoto implemented the bitcoin software as open source code and released it in January 2009 on SourceForge. The identity of Nakamoto remains unknown.In January 2009, the bitcoin network came into existence after Satoshi Nakamoto mined the first ever block on the chain, known as the genesis block.Embedded in the coinbase of this block was the following text:The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.

This note has been interpreted as both a timestamp of the genesis date and a derisive comment on the instability caused by fractional-reserve banking.The receiver of the first bitcoin transaction was cypherpunk Hal Finney, who created the first reusable proof-of-work system (RPOW) in 2004.Finney downloaded the bitcoin software the day it was released, and received 10 bitcoins from Nakamoto.Other early cypherpunk supporters were Wei Dai, creator of bitcoin predecessor b-money, and Nick Szabo, creator of bitcoin predecessor bit gold.

In the early days, Nakamoto is estimated to have mined 1 million bitcoins. In 2010, Nakamoto handed the network alert key and control of the Bitcoin Core code repository over to Gavin Andresen, who later became lead developer at the Bitcoin Foundation.Nakamoto subsequently disappeared from any involvement in bitcoin.Andresen stated he then sought to decentralize control, saying: "As soon as Satoshi stepped back and threw the project onto my shoulders, one of the first things I did was try to decentralize that. So, if I get hit by a bus, it would be clear that the project would go on." This left opportunity for controversy to develop over the future development path of bitcoin.On 1 August 2017, a hard fork of bitcoin was created, known as Bitcoin Cash. Bitcoin Cash has a larger block size limit and had an identical blockchain at the time of fork.On 12 November another hard fork, Bitcoin Gold, was created. Bitcoin Gold changes the proof-of-work algorithm used in mining

4)Design

A)Blockchain:-The blockchain is a public ledger that records bitcoin transactions.A novel solution accomplishes this without any trusted central authority: the maintenance of the blockchain is performed by a network of communicating nodes running bitcoin software.Transactions of the form payer X sends Y bitcoins to payee Z are broadcast to this network using readily available software applications.Network nodes can validate transactions, add them to their copy of the ledger, and then broadcast these ledger additions to other nodes. The blockchain is a distributed database – to achieve independent verification of the chain of ownership of any and every bitcoin amount, each network node stores its own copy of the blockchain. Approximately six times per hour, a new group of accepted transactions, a block, is created, added to the blockchain, and quickly published to all nodes. This allows bitcoin software to determine when a particular bitcoin amount has been spent, which is necessary in order to prevent double-spending in an environment without central oversight. Whereas a conventional ledger records the transfers of actual bills or promissory notes that exist apart from it, the blockchain is the only place that bitcoins can be said to exist in the form of unspent outputs of transactions

B)Transactions:-Transactions are defined using a Forth-like scripting language. Transactions consist of one or more inputs and one or more outputs. When a user sends bitcoins, the user designates each address and the amount of bitcoin being sent to that address in an output. To prevent double spending, each input must refer to a previous unspent output in the blockchain. The use of multiple inputs corresponds to the use of multiple coins in a cash transaction. Since transactions can have multiple outputs, users can send bitcoins to multiple recipients in one transaction. As in a cash transaction, the sum of inputs (coins used to pay) can exceed the intended sum of payments. In such a case, an additional output is used, returning the change back to the payer.Any input satoshis not accounted for in the transaction outputs become the transaction fee

C)Transaction fees:-Paying a transaction fee is optional.Miners can choose which transactions to process,and they are incentivised to prioritize those that pay higher fees.

Because the size of mined blocks is capped by the network, miners choose transactions based on the fee paid relative to their storage size, not the absolute amount of money paid as a fee. Thus, fees are generally measured in satoshis per byte, or sat/b. The size of transactions is dependent on the number of inputs used to create the transaction, and the number of outputs

D)Ownership:-In the blockchain, bitcoins are registered to bitcoin addresses. Creating a bitcoin address is nothing more than picking a random valid private key and computing the corresponding bitcoin address. This computation can be done in a split second. But the reverse (computing the private key of a given bitcoin address) is mathematically unfeasible and so users can tell others and make public a bitcoin address without compromising its corresponding private key. Moreover, the number of valid private keys is so vast that it is extremely unlikely someone will compute a key-pair that is already in use and has funds. The vast number of valid private keys makes it unfeasible that brute force could be used for that. To be able to spend the bitcoins, the owner must know the corresponding private key and digitally sign the transaction. The network verifies the signature using the public key.

If the private key is lost, the bitcoin network will not recognize any other evidence of ownership;the coins are then unusable, and effectively lost. For example, in 2013 one user claimed to have lost 7,500 bitcoins, worth $7.5 million at the time, when he accidentally discarded a hard drive containing his private key.A backup of his key(s) would have prevented this.

5)Mining:-

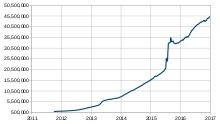

Amateur bitcoin mining with a small ASIC. This was when difficulty was much lower, and is no longer feasible.Semi-log plot of relative mining difficulty

Semi-log of reletive mining difficulty

Mining is a record-keeping service done through the use of computer processing power .Miners keep the blockchain consistent, complete, and unalterable by repeatedly grouping newly broadcast transactions into a block, which is then broadcast to the network and verified by recipient nodes.Each block contains a SHA-256 cryptographic hash of the previous block,thus linking it to the previous block and giving the blockchain its name.To be accepted by the rest of the network, a new block must contain

Comments (0)