A GUIDE FOR FINANCIAL FRAUD INVESTIGATION & PRECAUTION, SHIVANI SHARMA [read my book txt] 📗

- Author: SHIVANI SHARMA

Book online «A GUIDE FOR FINANCIAL FRAUD INVESTIGATION & PRECAUTION, SHIVANI SHARMA [read my book txt] 📗». Author SHIVANI SHARMA

B)General use:-

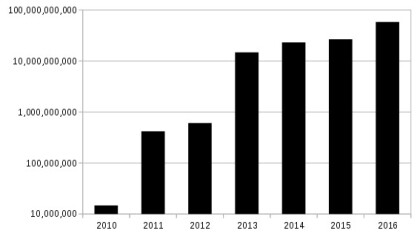

Liquidity (estimated, USD/year, logarithmic scale).

Liquidity (estimated, USD/year, logarithmic scale).

According to research produced by Cambridge University, there were between 2.9 million and 5.8 million unique users using a cryptocurrency wallet, as of 2017, most of them using bitcoin. The number of users has grown significantly since 2013, when there were 300,000 to 1.3 million users.

These are the following generale use of bit-coins:

A)Acceptance by merchantant.

B)Payment service providers

C)Financial institution

D)As an investment

E)Ventuer capital

F)Price and volality

G)Ponzi scheme and pyramid scheme coners

H)Speculative buble dispute

A)Acceptance by merchants:-In 2015, the number of merchants accepting bitcoin exceeded 100,000.Instead of 2–3% typically imposed by credit card processors, merchants accepting bitcoins often pay fees under 2%, down to 0%.Firms that accepted payments in bitcoin as of December 2014 included PayPal,Microsoft, Dell, and Newegg. In 2017 bitcoin's acceptance among major online retailers included three out of the top 500 online merchants, down from five in 2016. Reasons for this fall include high transaction fees due to bitcoin's scalability issues, long transaction times and a rise in value making consumers unwilling to spend it.In November 2017 PwC accepted bitcoin at its Hong Kong office in exchange for providing advisory services to local companies who are specialists in blockchain technology and cryptocurrencies, the first time any Big Four accounting firm accepted the cryptocurrency as payment.HYPERLINK "https://en.wikipedia.org/wiki/Bitcoin"]HYPERLINK "https://en.wikipedia.org/wiki/Bitcoin"

B)Payment service providers:-Merchants accepting bitcoin ordinarily use the services of bitcoin payment service providers such as BitPay or Coinbase. When a customer pays in bitcoin, the payment service provider accepts the bitcoin on behalf of the merchant, converts it to the local currency, and sends the obtained amount to merchant's bank account, charging a fee for the service

C)Financial institutions:-Bitcoins can be bought on digital currency exchanges. According to Tony HYPERLINK "https://en.wikipedia.org/wiki/Tony_Gallippi"Gallippi, a co-founder of BitPay, "banks are scared to deal with bitcoin companies, even if they really want to". In 2014, the National Australia Bank closed accounts of businesses with ties to bitcoin, and HSBC refused to serve a hedge fund with links to bitcoin. Australian banks in general have been reported as closing down bank accounts of operators of businesses involving the currency; this has become the subject of an investigation by the Australian Competition and Consumer Commission.Nonetheless, Australian banks have trialled trading between each other using the blockchain technology on which bitcoin is based.

In a 2013 report, Bank of America Merrill Lynch stated that "we believe bitcoin can become a major means of payment for e-commerce and may emerge as a serious competitor to traditional money-transfer providers."In June 2014, the first bank that converts deposits in currencies instantly to bitcoin without any fees was opened in Boston.Plans were announced to include a bitcoin futures option on the Chicago Mercantile Exchange in 2017. Trading in bitcoin futures was announced to begin on 10 December 2017.

D)As an investment:-Some Argentinians have bought bitcoins to protect their savings against high inflation or the possibility that governments could confiscate savings accounts. During the 2012–2013 Cypriot financial crisis, bitcoin purchases in Cyprus rose due to fears that savings accounts would be confiscated or taxed.The WinklevossHYPERLINK "https://en.wikipedia.org/wiki/Winklevoss_twins" twins have invested into bitcoins. In 2013 The Washington Post claimed that they owned 1% of all the bitcoins in existence at the time.

Other methods of investment are bitcoin funds. The first regulated bitcoin fund was established in Jersey in July 2014 and approved by the Jersey Financial Services Commission.Forbes started publishing arguments in favor of investing in December 2015.In 2013 and 2014, the European Banking AuthorityHYPERLINK "https://en.wikipedia.org/wiki/European_Banking_Authority"[131] and the Financial Industry Regulatory Authority (FINRA), a United States self-regulatory organization, warned that investing in bitcoins carries significant risks. Forbes named bitcoin the best investment of 2013.In 2014, Bloomberg named bitcoin one of its worst investments of the year. In 2015, bitcoin topped Bloomberg's currency tables.According to bitinfocharts.com, in 2017 there are 9,272 bitcoin wallets with more than $1 million worth of bitcoins.The exact number of bitcoin millionaires is uncertain as a single person can have more than one bitcoin wallet.

E)Venture capital:-Venture capitalists, such as Peter HYPERLINK "https://en.wikipedia.org/wiki/Peter_Thiel"Thiel's Founders Fund, which invested US$3 million in BitPay, do not purchase bitcoins themselves, instead funding bitcoin infrastructure like companies that provide payment systems to merchants, exchanges, wallet services, etc. In 2012, an incubator for bitcoin-focused start-ups was founded by Adam Draper, with financing help from his father, venture capitalist Tim Draper, one of the largest bitcoin holders after winning an auction of 30,000 bitcoins, at the time called 'mystery buyer'. The company's goal is to fund 100 bitcoin businesses within 2–3 years with $10,000 to $20,000 for a 6% stake. Investors also invest in bitcoin mining.According to a 2015 study by Paolo HYPERLINK "https://en.wikipedia.org/wiki/Paolo_Tasca"Tasca, bitcoin startups raised almost $1 billion in three years (Q1 2012 – Q1 2015).

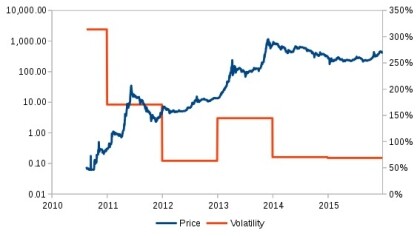

F)Price and volatility:-

Price (left y-axis, logarithmic scale) and volatility (right y-axis).

The price of bitcoins has gone through various cycles of appreciation and depreciation referred to by some as bubbles and busts.[142HYPERLINK "https://en.wikipedia.org/wiki/Bitcoin"]HYPERLINK "https://en.wikipedia.org/wiki/Bitcoin" In 2011, the value of one bitcoin rapidly rose from about US$0.30 to US$32 before returning to US$2. In the latter half of 2012 and during the 2012–13 Cypriot financial crisis, the bitcoin price began to rise, reaching a high of US$266 on 10 April 2013, before crashing to around US$50.On 29 November 2013, the cost of one bitcoin rose to a peak of US$1,242. In 2014, the price fell sharply, and as of April remained depressed at little more than half 2013 prices. As of August 2014 it was under US$600.

According to Mark T. Williams, as of 2014, bitcoin has volatility seven times greater than gold, eight times greater than the SHYPERLINK "https://en.wikipedia.org/wiki/S%26P_500"&HYPERLINK "https://en.wikipedia.org/wiki/S%26P_500"P 500, and 18 times greater than the US dollar. According to Forbes, there are uses where volatility does not matter, such as online gambling, tipping, and international remittances.

According to an article in The Wall Street Journal, as of 19 April 2016, bitcoin had been more stable than gold for the preceding 24 days, and it was suggested that its value might be more stable in the future.On 3 March 2017, the price of a bitcoin surpassed the market value of an ounce of gold for the first time as its price surged to an all-time high of $1,268.[152]HYPERLINK "https://en.wikipedia.org/wiki/Bitcoin".A study in Electronic Commerce Research and Applications, going back through the network's historical data, showed the value of the bitcoin network as measured by the price of bitcoins, to be roughly proportional to the square of the number of daily unique users participating on the network, i.e. that the network is "fairly well modeled by the Metcalfe's law".

G)Ponzi scheme and pyramid scheme concerns:-Various journalists,[84]HYPERLINK "https://en.wikipedia.org/wiki/Bitcoin".economists,[156]HYPERLINK "https://en.wikipedia.org/wiki/Bitcoin"[157] and the central bank of Estonia have voiced concerns that bitcoin is a PonziHYPERLINK "https://en.wikipedia.org/wiki/Ponzi_scheme" scheme. In 2013, Eric Posner, a law professor at the University of Chicago, stated that "a real Ponzi scheme takes fraud; bitcoin, by contrast, seems more like a collective delusion." A 2014 report by the World Bank concluded that bitcoin was not a deliberate Ponzi scheme. The Swiss Federal HYPERLINK "https://en.wikipedia.org/wiki/Federal_Council_%28Switzerland%29"CouncilHYPERLINK "https://en.wikipedia.org/wiki/Federal_Council_%28Switzerland%29" examined the concerns that bitcoin might be a pyramid scheme; it concluded that "Since in the case of bitcoin the typical promises of profits are lacking, it cannot be assumed that bitcoin is a pyramid scheme." In July 2017, billionaire Howard Marks referred to bitcoin as a pyramid scheme.

On 12 September 2017, Jamie HYPERLINK "https://en.wikipedia.org/wiki/Jamie_Dimon"Dimon, CEO of JP Morgan Chase, called bitcoin a "fraud" and said he would fire anyone in his firm caught trading it. Zero Hedge claimed that the same day Dimon made his statement, JP Morgan also purchased a large amount of bitcoins for its clients.In a January 2018 interview Dimon voiced regrets about his earlier remarks, and said "The blockchain is real. You can have cryptodollars in yen and stuff like that. ICOs ... you got to look at every one individually."

H)Speculative bubble dispute:-Bitcoin has been labelled a speculative bubble by many including former Fed Chairman Alan GreenspanHYPERLINK "https://en.wikipedia.org/wiki/Alan_Greenspan"and economist John HYPERLINK "https://en.wikipedia.org/wiki/John_Quiggin"Quiggin.Nobel Memorial Prize laureate Robert HYPERLINK "https://en.wikipedia.org/wiki/Robert_Shiller"Shiller said that bitcoin "exhibited many of the characteristics of a speculative bubble".Journalist Matthew Boesler in 2013 rejected the speculative bubble label and saw bitcoin's quick rise in price as nothing more than normal economic forces at work.Timothy B. Lee, in a 2013 piece for The Washington Post pointed out that the observed cycles of appreciation and depreciation don't correspond to the definition of speculative bubble. On 14 March 2014, the American business magnate Warren Buffett said, "Stay away from it. It's a mirage, basically." During their time as bitcoin developers, Gavin Andresen and Mike Hearn warned that bubbles may occur.

13)Legal status, tax and regulation:-Because of bitcoin's decentralized nature, nation-states cannot shut down the network or alter its technical rules. However, the use of bitcoin can be criminalized, and shutting down exchanges and the peer-to-peer economy in a given country would constitute a "de facto ban".The legal status of bitcoin varies substantially from country to country and is still undefined or changing in many of them. While some countries have explicitly allowed its use and trade, others have banned or restricted it. Regulations and bans that apply to bitcoin probably extend to similar cryptocurrency systems.

14)Energy consumption:-Bitcoin has been criticized for the amounts of electricity consumed by mining. As of 2015, The Economist estimated that even if all miners used modern facilities, the combined electricity consumption would be 166.7 megawatts (1.46 terawatt-hours per year).At the end of 2017, the global monthly bitcoin mining activity was estimated to consume between 1 and 4 gigawatts of electricity. Politico noted that the banking sector today consumes about 6% of total global power, and even if bitcoin's consumption levels increased 100 fold from today's levels, bitcoin's consumption would still only amount to about 2% of global power consumption.

To lower the costs, bitcoin miners have set up in places like Iceland where geothermal energy is cheap and cooling Arctic air is free. Bitcoin miners are known to use hydroelectric power in Tibet, Quebec, Washington

Comments (0)