A GUIDE FOR FINANCIAL FRAUD INVESTIGATION & PRECAUTION, SHIVANI SHARMA [read my book txt] 📗

- Author: SHIVANI SHARMA

Book online «A GUIDE FOR FINANCIAL FRAUD INVESTIGATION & PRECAUTION, SHIVANI SHARMA [read my book txt] 📗». Author SHIVANI SHARMA

Every 2,016 blocks (approximately 14 days at roughly 10 min per block), the difficulty target is adjusted based on the network's recent performance, with the aim of keeping the average time between new blocks at ten minutes. In this way the system automatically adapts to the total amount of mining power on the network.Between 1 March 2014 and 1 March 2015, the average number of nonces miners had to try before creating a new block increased from 16.4 quintillion to 200.5 quintillion.The proof-of-work system, alongside the chaining of blocks, makes modifications of the blockchain extremely hard, as an attacker must modify all subsequent blocks in order for the modifications of one block to be accepted.As new blocks are mined all the time, the difficulty of modifying a block increases as time passes and the number of subsequent blocks (also called confirmations of the given block) increases.

A)Pooled mining:-Computing power is often bundled together or "pooled" to reduce variance in miner income. Individual mining rigs often have to wait for long periods to confirm a block of transactions and receive payment. In a pool, all participating miners get paid every time a participating server solves a block. This payment depends on the amount of work an individual miner contributed to help find that block.

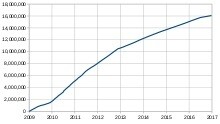

6)Supply:-Total bitcoins in circulation.

The successful miner finding the new block is rewarded with newly created bitcoins and transaction fees.As of 9 July 2016, the reward amounted to 12.5 newly created bitcoins per block added to the blockchain. To claim the reward, a special transaction called a coinbase is included with the processed payments.All bitcoins in existence have been created in such coinbase transactions. The bitcoin protocol specifies that the reward for adding a block will be halved every 210,000 blocks (approximately every four years). Eventually, the reward will decrease to zero, and the limit of 21 million bit-coins will be reached c. 2140; the record keeping will then be rewarded by transaction fees solely.

In other words, bitcoin's inventor Nakamoto set a monetary policy based on artificial scarcity at bitcoin's inception that there would only ever be 21 million bitcoins in total. Their numbers are being released roughly every ten minutes and the rate at which they are generated would drop by half every four years until all were in circulation.

A)Wallets:-For a broader coverage related to this topic, see Cryptocurrency wallet.A wallet stores the information necessary to transact bitcoins. While wallets are often described as a place to hold or store bitcoins, due to the nature of the system, bitcoins are inseparable from the blockchain transaction ledger. A better way to describe a wallet is something that "stores the digital credentials for your bitcoin holdings" and allows one to access (and spend) them. Bitcoin uses public-key cryptography, in which two cryptographic keys, one public and one private, are generated. At its most basic, a wallet is a collection of these keys.

There are three modes which wallets can operate in. They have an inverse relationship with regards to trustlessness and computational requirements.

⦁ Full clients verify transactions directly on a local copy of the blockchain (over 150 GB As of January 2018).They are the most secure and reliable way of using the network, as trust in external parties is not required. Full clients check the validity of mined blocks, preventing them from transacting on a chain that breaks or alters network rules.⦁ [Because of its size and complexity, storing the entire blockchain is not suitable for all computing devices.

⦁ Pruning clients store only the set of transactions that have not been spent (the "⦁ UTXO set"), thereby reducing the size of data they need to store, while simultaneously allowing them to validate new transactions.However, if miners alter the blockchain at a point suitably far back in time (a "reorg"), the pruning client must re-validate the entire blockchain from its genesis.

⦁ Lightweight clients consult full clients to send and receive transactions without requiring a local copy of the entire blockchain (see ⦁ simplified payment verification – SPV). This makes lightweight clients much faster to set up and allows them to be used on low-power, low-bandwidth devices such as smartphones. When using a lightweight wallet, however, the user must trust the server to a certain degree, as it can report faulty values back to the user. Lightweight clients follow the longest blockchain and do not ensure it is valid, requiring trust in miners.

Third-party internet services called online wallets offer similar functionality but may be easier to use. In this case, credentials to access funds are stored with the online wallet provider rather than on the user's hardware. As a result, the user must have complete trust in the wallet provider. A malicious provider or a breach in server security may cause entrusted bitcoins to be stolen. An example of such a security breach occurred with Mt. Gox in 2011. This has led to the often-repeated meme "Not your keys, not your bitcoin".

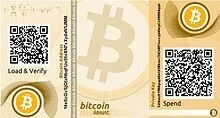

BIT COIN PAPER WALLET

Trezoer hardware wallet

Physical wallets store offline the credentials necessary to spend bitcoins. One notable example was a novelty coin with these credentials printed on the reverse side.Paper wallets are simply paper printouts.

Another type of wallet called a hardware wallet keeps credentials offline while facilitating transactions.

7)Reference implementation:-The first wallet program – simply named "Bitcoin" – was released in 2009 by Satoshi HYPERLINK "https://en.wikipedia.org/wiki/Satoshi_Nakamoto"Nakamoto as open-source code. In version 0.5 the client moved from the wxWidgets user interface toolkit to Qt, and the whole bundle was referred to as "Bitcoin-Qt". After the release of version 0.9, the software bundle was renamed "Bitcoin Core" to distinguish itself from the underlying network.[78HYPERLINK "https://en.wikipedia.org/wiki/Bitcoin"]HYPERLINK "https://en.wikipedia.org/wiki/Bitcoin" It is sometimes referred to as the "Satoshi client".

While a decentralized system cannot have an "official" implementation, Bitcoin Core is considered to be bitcoin's reference client.As such, it serves to define the bitcoin protocol and acts as a standard for other implementations. Today, other alternative clients (forks of Bitcoin Core) exist, such as BitcoinHYPERLINK "https://en.wikipedia.org/wiki/Bitcoin_XT" XT, BitcoinHYPERLINK "https://en.wikipedia.org/wiki/Bitcoin_Unlimited" Unlimited,HYPERLINK "https://en.wikipedia.org/wiki/Bitcoin" and Parity Bitcoin.

8)Decentralization:-Bitcoin was designed not to need a central authority and the bitcoin network is considered to be decentralized.HYPERLINK "https://en.wikipedia.org/wiki/Bitcoin"HYPERLINK "https://en.wikipedia.org/wiki/Bitcoin"HYPERLINK "https://en.wikipedia.org/wiki/Bitcoin".HYPERLINK "https://en.wikipedia.org/wiki/Bitcoin"HYPERLINK "https://en.wikipedia.org/wiki/Bitcoin".However, researchers have pointed out a visible "trend towards centralization" by the means of miners joining large mining pools to minimise the variance of their income.According to researchers, other parts of the ecosystem are also "controlled by a small set of entities", notably online wallets and simplified payment verification (SPV) clients.

Because transactions on the network are confirmed by miners, decentralization of the network requires that no single miner or mining pool obtains 51% of the hashing power, which would allow them to double-spend coins, prevent certain transactions from being verified and prevent other miners from earning income. As of 2013 just six mining pools controlled 75% of overall bitcoin hashing power.In 2014 mining pool Ghash.io obtained 51% hashing power which raised significant controversies about the safety of the network. The pool has voluntarily capped their hashing power at 39.99% and requested other pools to act responsibly for the benefit of the whole network.

9)Privacy:-Bitcoin is pseudonymous, meaning that funds are not tied to real-world entities but rather bitcoin addresses. Owners of bitcoin addresses are not explicitly identified, but all transactions on the blockchain are public. In addition, transactions can be linked to individuals and companies through "idioms of use" (e.g., transactions that spend coins from multiple inputs indicate that the inputs may have a common owner) and corroborating public transaction data with known information on owners of certain addresses. Additionally, bitcoin exchanges, where bitcoins are traded for traditional currencies, may be required by law to collect personal information.

To heighten financial privacy, a new bitcoin address can be generated for each transaction. For example, hierarchical deterministic wallets generate pseudorandom "rolling addresses" for every transaction from a single seed, while only requiring a single passphrase to be remembered to recover all corresponding private keys.Researchers at Stanford University and Concordia University have also shown that bitcoin exchanges and other entities can prove assets, liabilities, and solvency without revealing their addresses using zero-knowledge proofs."Bulletproofs," a version of Confidential Transactions proposed by Greg Maxwell, have been tested by Professor Dan HYPERLINK "https://en.wikipedia.org/wiki/Dan_Boneh"Boneh of Stanford. Other solutions such Merkelized Abstract Syntax Trees (MAST), pay-to-script-hash (P2SH) with MERKLE-BRANCH-VERIFY, and "Tail Call Execution Semantics, have also been proposed to support private smart contracts.

10)Fungibility:-Wallets and similar software technically handle all bitcoins as equivalent, establishing the basic level of fungibility. Researchers have pointed out that the history of each bitcoin is registered and publicly available in the blockchain ledger, and that some users may refuse to accept bitcoins coming from controversial transactions, which would harm bitcoin's fungibility. Projects such as CryptoNote, Zerocoin, and Dark Wallet aim to address these privacy and fungibility issues.HYPERLINK "https://en.wikipedia.org/wiki/Bitcoin"]HYPERLINK "https://en.wikipedia.org/wiki/Bitcoin"

11)Scalability:-The blocks in the blockchain were not limited originally. The block size limit of one megabyte was introduced by Satoshi Nakamoto in 2010, as an anti-spam measure. Eventually the block size limit of one megabyte created problems for transaction processing, such as increasing transaction fees and delayed processing of transactions that cannot be fit into a block.

On 24 August 2017 (at block 481,824), Segregated Witness (SegWit) went live, introducing a new transaction format where signature data is separated and known as the witness. The upgrade replaced the block size limit with a limit on a new measure called block weight, which counts non-witness data four times as much as witness data, and allows a maximum weight of 4 megabytes.[99HYPERLINK "https://en.wikipedia.org/wiki/Bitcoin"]HYPERLINK "https://en.wikipedia.org/wiki/Bitcoin"HYPERLINK "https://en.wikipedia.org/wiki/Bitcoin"Thus, per computer scientist Jochen Hoenicke, the actual block capacity depends on the ratio of SegWit transactions in the block, and on the ratio of signature data. Based on his estimate, if the ratio of SegWit transactions is 50%, the block capacity may be 1.25 megabytes. According to Hoenicke, if native SegWit addresses from Bitcoin Core version 0.16.0 are used,and SegWit adoption reaches 90 to 95%, a block size of up to 1.8 megabytes is possible.

12)Economics:-

A)Classification:-Bitcoin is a digital asset designed by its inventor, Satoshi Nakamoto, to work as a currency.HYPERLINK "https://en.wikipedia.org/wiki/Bitcoin"It is commonly referred to with terms like digital currency, digital cash,virtual currency, electronic currency,or cryptocurrency.

Comments (0)